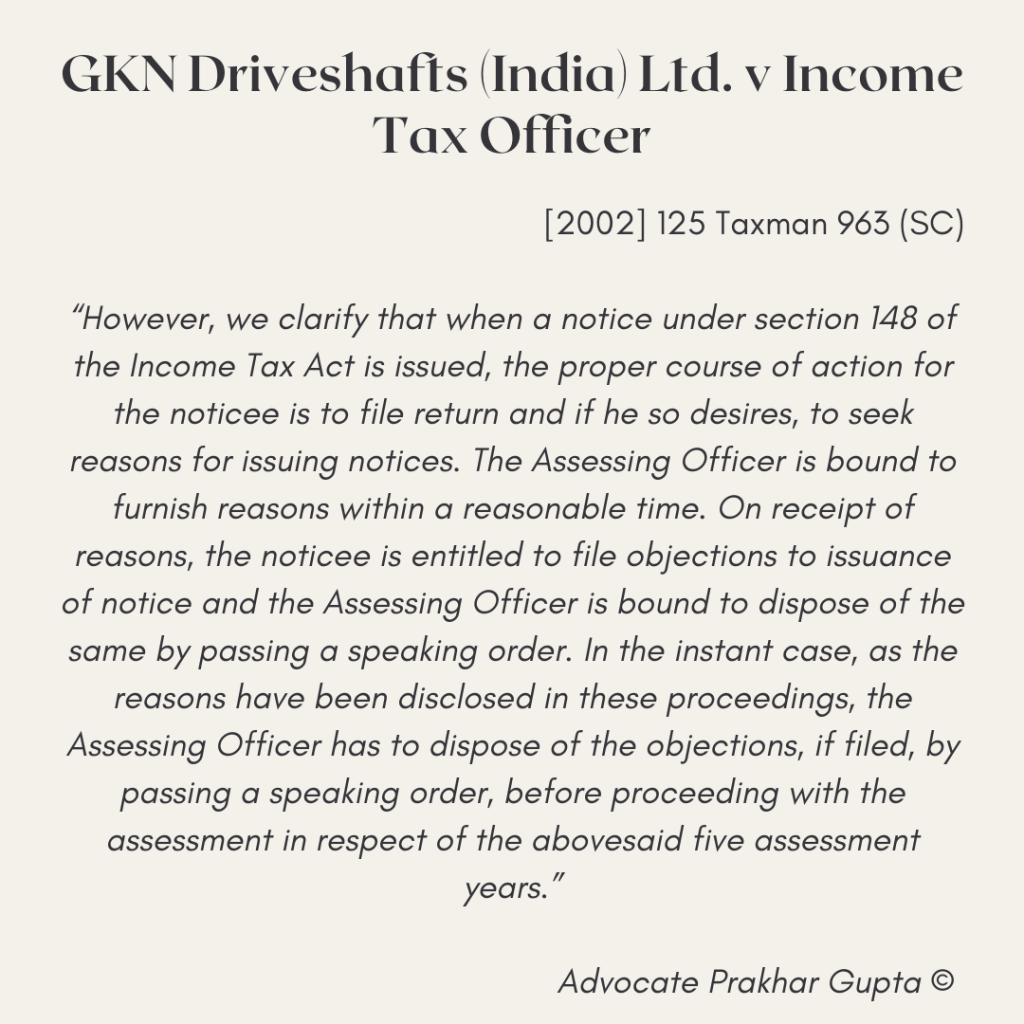

GKN Driveshafts (India) Ltd. is one of the most landmark judgments in regards to the interpretation of S. 148 of the Income-tax. It primarily talks about the Assessee’s right to seek reasons for notice given under the aegis of S 148 of Income Tax. The judgment suggests a model way tackle notices received under the aegis of S 148 and suggests that the Assessee ought to file a revised return and at the same time, may demand reasons. There is no mention of whether demand for reasons ought to be ante or post the filing of revised return. Therefore, the demand for reasons can be made any time, even before filing the revised return, thereby bounding the Assessing officer to give the reasons within a reasonable time.