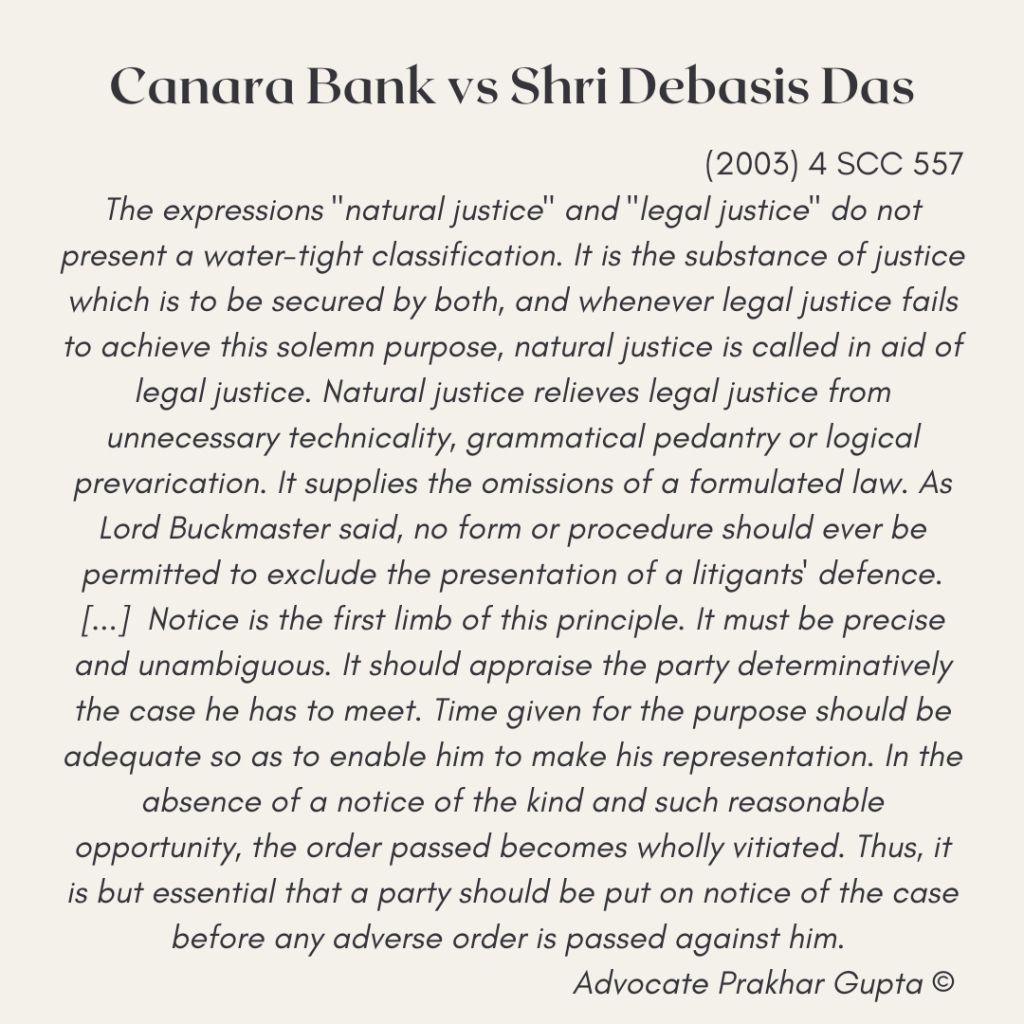

This is in continuation to the post I made yesterday, therein it was contended that under the aegis of Section 148 of Income Tax Act, 1961, the assessing officer while issuing the notice ought to have disclosed the “reasons of belief”. Whereas the subsection of the abovementioned section makes it compulsory on part of the assessing officer to record the reasons for such belief but nowhere obliges that the same may be disclosed with notice. Where the statute is silent about the observance of the principles of natural justice, such statutory silence is taken to imply compliance with the principles of natural justice, unless expressly excluded therein. Therefore this requirement of natural justice must be read in the judgment.